Tracing the Trajectory of OKB: A Detailed Market Analysis and Forecast

In the rapidly evolving landscape of cryptocurrency, OKB has emerged as a utility token of the OKEx exchange, one of the world’s leading digital asset exchanges. The unique value proposition of OKB extends beyond simple token transactions; it’s integrated deeply into the OKEx ecosystem, offering users various benefits and participating in the exchange’s governance. As the cryptocurrency market remains highly unpredictable, an in-depth understanding of the current situation and possible future trends of OKB is imperative for investors. This article provides a detailed analysis of OKB based on our most recent data.

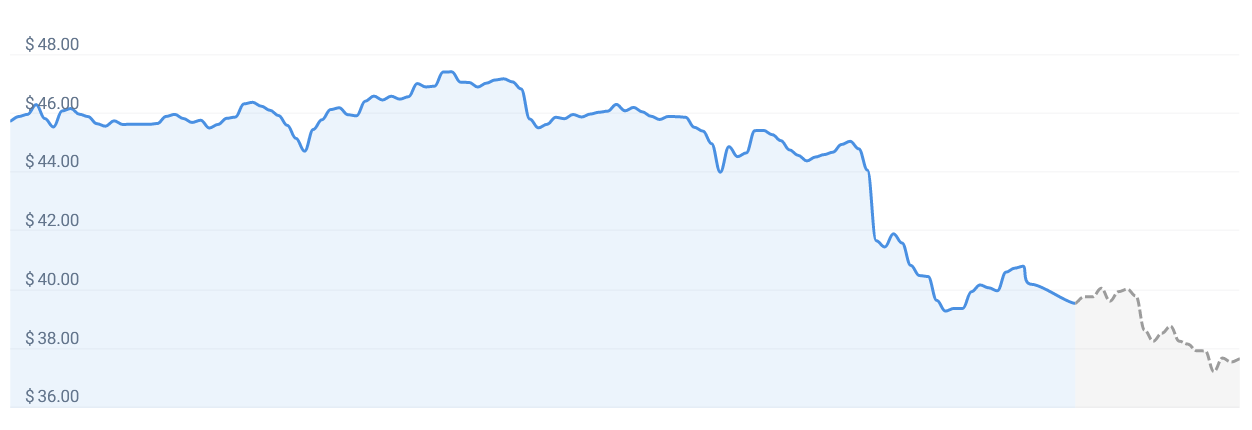

Our current price prediction for OKB indicates a decrease of roughly 4.99%, suggesting that its value might fall to around $37.67 by June 20, 2023. However, it’s important to understand that any price prediction cannot be entirely accurate due to the highly volatile and unpredictable nature of the cryptocurrency market.

The current sentiment towards OKB, as reflected by our technical indicators, is bearish. A bearish sentiment in the market is suggestive of a negative outlook, with expectations of price decreases in the foreseeable future. Market sentiment is a critical measure of the collective attitude of investors and can significantly influence price movements.

Further enriching our understanding of the market mood is the Fear & Greed Index, currently showing a score of 41 for OKB, indicating ‘Fear’. This tool gauges the dominant emotions driving the market, with a score of 41 indicating a degree of caution or even worry among investors.

However, it’s vital to consider the recent performance of OKB to get a fuller picture of the market situation. Over the past 30 days, OKB recorded 14 ‘green days,’ i.e., days when the price increased, contributing to a positivity rate of 47% in the past month. This statistic indicates that despite the bearish sentiment and fear, the asset still has a relatively balanced rate of positive price movements.

Still, the price volatility of OKB stands at 4.62% over the past 30 days. The high volatility implies substantial price fluctuations, offering both potential profits and significant risks. While the prospect of high returns might allure investors, it’s crucial to acknowledge the associated risks and invest wisely.

Given the bearish sentiment, the Fear & Greed Index, and the considerable price volatility, our forecast suggests that it may not be the best time to invest in OKB. The confluence of these factors points to a high-risk environment, making it crucial for investors to approach with caution.

However, it’s important to remember that these predictions and analyses should not be viewed as absolute certainties but rather as useful tools to help guide investment decisions. Potential investors should stay informed about market trends, monitor relevant news, and ideally seek advice from financial professionals before making investment decisions.

In conclusion, our forecast predicts a decrease in the value of OKB, with a projected price of $37.67 by June 20, 2023. The current market sentiment indicates caution, corroborated by the Fear & Greed Index. This collective data suggests that it may not be the most favorable time to invest in OKB. As always, potential investors should carefully consider their risk tolerance and maintain a keen eye on market trends before making any investment decisions. The promise of high returns in the cryptocurrency market goes hand in hand with the risk of substantial losses, highlighting the importance of careful and informed investment strategies.